How Litigation Finance Works

Making Millions Off Other People’s Lawsuits

When Peter Thiel financed Hulk Hogan’s invasion of privacy lawsuit in 2016, many pundits thought it was an example of a new phenomenon sweeping the legal sector called litigation finance.

“But that suit wasn’t really litigation finance. That was just Peter Thiel trying to settle a score,” said Roy Strom, Bloomberg Law reporter covering the business of law.

What is litigation finance?

In a nutshell, litigation finance is when a third party invests in a lawsuit in exchange for a share of the profit. The idea is that a good legal claim is like an asset. It’s worth money, but there’s risk. The case is worth money only if you win in court. So if you lose, investors are out all their money.

Having anyone other than the direct parties to the litigation profit from a suit has historically been prohibited. This is the legal doctrine known as champerty.

“Champerty is just a fancy legal name for the basic principle that traditionally the law prohibited a non-party from funding a party for a profit,” explained Maya Steinitz, law professor at the University of Iowa.

Champerty laws date back to the Middle Ages in England when unscrupulous feudal lords would fund the claims of their underlings in order to harass one another.

“And the idea was to protect the court system, which at the time was weak from being used for purposes that were not achieving justice,” Steinitz said.

Over time, the practice of funding others’ legal claims for profit went the way of jousting and the plague, until 1993 when New South Wales in Australia rolled back its antiquated champerty laws. Lawmakers there wanted to allow outside interests to fund class actions, which were notoriously expensive. Sensing opportunity, entrepreneurial investors started financing other cases in need of funding and taking a cut of the profits, and an industry was born.

“Litigation funders love to say that some plaintiffs without money from the funders just wouldn’t be able to afford the costs of litigation,” Strom said. “Whatever injustice happened to these parties would just go on challenged.”

Litigation funding is now (unregulated) big business

Eventually the practice found its way back to England and to the United States, where litigation funding has become big business.

According to one recent study, there are as many as 40 funders. Together they have about $10 billion in capital. In the past year alone, they’ve spent close to $2.5 billion investing in cases. That growth has caught regulators, lawmakers, and big law firms off guard. In many ways, the world of litigation finance is still the Wild West.

“Currently there aren’t any regulations or laws that directly regulate litigation funding at all,” Steinitz said.

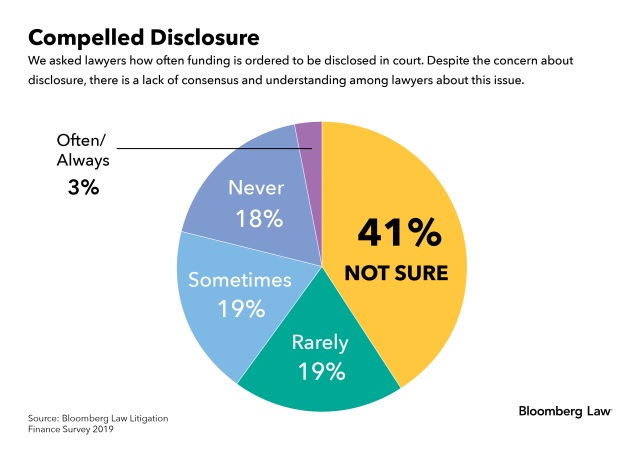

“If I had to predict, I would say that some measure of disclosure will certainly become part of the regulatory landscape in the coming years,” Steinitz added. “What kind of disclosure, just how much needs to be disclosed, and at what point of the litigation does it need to be disclosed.”

[See Bloomberg Law’s exclusive Practical Guidance for an overview of the litigation finance industry.]

Will litigation finance impact legal strategy?

One concern over litigation finance is whether it will lead to frivolous lawsuits.

“Funders point to the economics of it and say it doesn’t make sense from a money standpoint to be paying for cases that aren’t going to win,” Strom said. “Another concern is whether the funders will exert control over plaintiffs and key decisions in the case, like when to settle or when to go to trial. And litigation funders will tell you that that’s not something they’re doing. It’s a really hot-button issue for litigation funders.”

The disconnect between what litigation funders and their clients (and potential clients) believe about the industry was also evident in the results of Bloomberg Law’s 2021 Litigation Finance Market Survey. When asked what their biggest concerns were as they considered using litigation finance, the two answers most frequently chosen by lawyers were ethical concerns and privilege concerns. Meanwhile, litigation funders answered that their clients were most concerned that they didn’t understand how funding works.

[A perfect litigation tool. Sign up for your guided Bloomberg Law demo today.]