Cryptocurrency Laws and Regulations by State

[Get the latest insights on increasing federal regulation of digital assets including analysis of developing tax implications in our report: Cryptocurrency: From the IRS to the SEC & Beyond.]

What is cryptocurrency?

Digital or virtual currency is an electronic medium of exchange that is not a representation of U.S. or foreign currency. Cryptocurrency is a type of digital currency that utilizes cryptography to secure transactions that are digitally recorded on a distributed ledger, such as a blockchain. According to the IRS: “Units of cryptocurrency are generally referred to as coins or tokens. Distributed ledger technology uses independent digital systems to record, share, and synchronize transactions, the details of which are recorded in multiple places at the same time with no central data store or administration functionality.”

Are transactions of cryptocurrency covered by the Bank Secrecy Act and anti-money-laundering laws?

Yes. The Anti-Money Laundering Act of 2020 codifies prior Financial Crimes Enforcement Network (FinCEN) guidance by making all transactions in “value that substitutes for currency” subject to reporting requirements and money transmitter registration; this definition includes digital currency.

Is there federal legislation related to cryptocurrency?

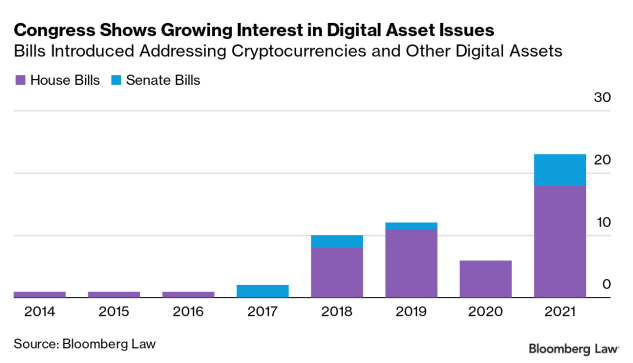

So far, Congress has left the task of addressing issues created by digital assets to regulatory agencies. A Congressional Blockchain Caucus formed in 2016. House and Senate members introduced few bills addressing digital assets until 2018, but interest appears to be growing.

What are the cryptocurrency laws by state?

While many states regulate virtual currency under existing money transmitter rules, specific cryptocurrency laws and regulations vary state-by-state.

Alabama

A license is required for selling or issuing payment instruments, stored value, or receiving money or monetary value for transmission. “Monetary value” means a medium of exchange, including virtual or fiat currencies, whether or not redeemable in money. (Ala. Code § 8-7A-2; Ala. Code § 8-7A-5)

Alaska

Alaska Stat. § 06.55.990(15) defines money services as, “selling or issuing payment instruments or stored value, or receiving money or monetary value for transmission.” The Alaska Division of Banking and Securities states, “[c]ompanies dealing with fiat and virtual currencies (cryptocurrencies) must apply for a money transmitter license, then enter into a Limited Licensing Agreement (LLA) with the State of Alaska.”

Arizona

The definition of a money transmitter is found at Ariz. Rev. Stat. § 6-1201(). While the definition does not specifically apply to digital currency, exchanges Coinbase and Binance interpret it to require them to acquire Arizona money transmitter licenses.

Arkansas

Arkansas’s definition of money transmission expressly includes virtual currency; A.C.A. § 23-55-102(12)(A), and allows investment in virtual currency by money transmitters; A.C.A. § 23-55-701(b).

However, Arkansas has provided “no-action” letters to digital asset-issuing businesses freeing them from money transmission licensing requirements, e.g., In re Mythical, Inc. (June 22, 2020) (video game internal currency) ; In re River Financial, Inc. (May 21, 2020) (selling own reserves of Bitcoin)

California

The Department of Financial Protection and Innovation has not decided whether to regulate digital currency transmission under California’s Money Transmission Act, see DFPI Statement re: Coinbase (Jan. 27, 2015) ; DFPI Opinion Request (Oct. 4, 2019) .

The DFPI regularly provides no-action letters regarding digital currency businesses on its website . Digital currency ATMs are often exempted, and a May 27, 2021 opinion letter exempted a peer-to-peer digital currency transaction platform from money transmission licensing.

Colorado

Colorado’s 2018 interim guidance requires licensing as a money transmitter when using digital currency as a payment system.

Connecticut

A money transmitter license is required when transmitting digital currency, see

Conn. Gen. Stat. § 36a-596(18); Conn. Gen. Stat. § 36a-597. The licensee must state that it is dealing in virtual currency. Conn. Gen. Stat. § 36a-598(a)(iv). Connecticut may apply additional scrutiny or requirements on virtual currency money transmitters. Conn. Gen. Stat. § 36a-600(c), (d); Conn. Gen. Stat. § 36a-602(a). Money transmitters must hold reserves in the same type and amount of virtual currency as all outstanding transactions. Conn. Gen. Stat. § 36a-603(b).

Connecticut’s Department of Banking has issued advisory opinions stating that digital currency exchanges are money transmitters, but digital currency “ATMs” are not. See Connecticut Department of Banking, “Virtual Currency Money Transmission FAQs“

Delaware

5 Del. C. § 2303 requires a license for the undefined phrase “engage in the business of receiving money for transmission or transmitting the same.” Virtual currency exchanges Coinbase and Binance maintain Delaware money transmitter licenses.

District of Columbia

Dealing in digital currency is money transmission requiring a license under D.C. law. See United States v. Harmon, 474 F. Supp. 3d 76, 89 (D.D.C. 2020).

Florida

A “money transmitter” under Fla. Stat. §560.103(23) “receives currency, monetary value, or payment instruments for the purpose of transmitting the same by any means”; a Florida appellate court found that this includes trade in digital currency. State v. Espinoza, 264 So. 3d 1055 (Fla. Dist. Ct. App. 2019). See also Fla. Stat. §896.101(f) (the Florida Money Laundering Act). Florida’s amnesty period to comply with the Espinoza decision ends Dec. 31, 2021. See “Industry Alert: Amnesty Period for Virtual Currency Sellers“

Even before Espinoza, Florida considered the sale of a digital token tied to the ownership of a gram of gold to be governed by money transmitter laws. See In re G-Wallet Corp. (June 5, 2019). Florida has not yet considered whether money transmitter laws apply to digital tokens tied to less fungible objects of value.

The Florida Financial Technology Sandbox allows for the sandbox permission to substitute for a money transmitter license during the license period and relaxes a few other money transmitter requirements. Fla. Stat. §559.952(4)(a)(3) through (14)

Georgia

Georgia’s money transmission laws define “money transmission” as receiving or transmitting “monetary value,” and “virtual currency” is specifically defined as “a digital representation of monetary value.” O.C.G.A. §7-1-680(13), (26). Therefore, a license is required under O.C.G.A. §7-1-681, and Georgia regulators have the power to enact virtual currency-specific rules. O.C.G.A. §7-1-690.

See also Georgia Department of Banking and Finance, “Money Transmission and the Sale of Payment Instruments“ ; cf. “Department of Banking and Finance Orders CampBX, Bitcoin Trading Platform, to Cease and Desist“ (July 26, 2018)

Hawaii

Haw. Rev. Stat. § 489D-4 defines money transmission with the broad “receiving money or monetary value for transmission,” but digital currency businesses are, through June 30, 2022, instead given permission through the Digital Currency Innovation Lab in order to determine what licensing is necessary. See “DCIL FAQs“ (Aug. 26, 2021)

Idaho

Idaho considers virtual currency exchanges to fall under the definition of money transmission requiring a license. See Idaho Department of Finance .

The Department of Finance regularly issues no-action letters to businesses such as digital currency ATMs freeing them from licensing requirements. Redacted no-action letters can be found on the Department of Finance’s web site.

Illinois

The definition of “money transmitter” in 205 ILCS 657/5 does not expressly mention digital assets; however, the Department of Financial and Professional Regulation released guidance as to when a digital currency business must register as a money transmitter. See Digital Currency Regulatory Guidance (June 13, 2017) .

The Division of Financial Institutions regularly issues “non-binding statements” to virtual currency businesses ruling on whether the businesses must be licensed. These statements can be found on the Department of Finance’s web site.

Indiana

The definition of money transmission in Ind. Code § 28-8-4-13 does not expressly mention virtual assets and may exclude virtual assets, including virtual currency, if sold for any purpose other than immediately facilitating a payment.

According to the Indiana money transmitter licensing FAQ on NMLS , a virtual currency exchange does not generally require a money transmitter license.

Iowa

There is no exclusion for digital currency businesses from Iowa’s Uniform Money Services Act in Iowa Code § 533C.103. Digital currency dealers such as Coinbase have obtained money services licenses from the Iowa Department of Banking.

Kansas

K.S.A. § 9-508(h)‘s definition of money transmission is broad enough to include digital currency.

However, under current administrative guidance a money transmitter license is not required when transmitting a decentralized digital currency; should the transmission of digital currency include the involvement of sovereign currency, a money transmitter license may be required. See Office of the State Bank Commissioner, “Regulatory Treatment of Virtual Currencies Under the Kansas Money Transmitter Act“ (May 18, 2021).

Kentucky

KRS 286.11-003 defines money transmission as “receiving money or monetary value to transmit…money or monetary value to another location inside or outside the United States by any and all means” which does not expressly include or exclude digital currency. Digital currency dealers such as Coinbase have obtained money services licenses from the Department of Financial Institutions.

Louisiana

The Louisiana Virtual Currency Businesses Act, La. Rev. Stat. §§ 6:1381 to 6:1394, provides a licensing scheme for virtual currency businesses. There is a long list of exceptions to licensing in La. Rev. Stat. § 6:1383(B) and (C), including all virtual currency regulated by Louisiana securities law and personal or academic use of virtual currency to buy goods and services.

Some exceptions may fall under the broad definition of money transmission under La. Rev. Stat. § 6:1032(13); Louisiana’s Office of Financial Institutions still maintains its 2014 guidance stating that virtual currency exchangers require a money transmitter license.

Maine

As of Oct. 18, 2021, “virtual currency” is explicitly included in Maine’s definition of money transmission, 32 MRSA §6102(10).

Maryland

As of October 1, 2021, the definition of “money transmission” in Md. Code, Fin. Inst. § 12-401(n)(1) includes “receiving…other value that substitutes for currency” (“currency” having the definition under 31 C.F.R. § 1010.100(m) as fiat currency) and transmitting it.

According to guidance on the Maryland Office of the Commissioner of Financial Regulation website , “an administrator or exchanger that accepts and transmits a convertible virtual currency or buys or sells convertible virtual currency for any reason is a money transmitter under federal regulations.” The Office also states on its regulated industries page that its regulation of money transmission is “including transmission of virtual currency.”

Digital currency businesses such as Binance and Coinbase currently maintain Maryland money transmitter licenses.

Massachusetts

Massachusetts’s regulation of money transmission is only money transmission to foreign countries. See 209 CMR 45.02; Mass.gov, “Apply for a Money Transmitter License“ .

In a 2020 opinion letter, the Massachusetts Department of Banking found that transactions where fiat currency was exchanged for virtual currency between two parties across international borders, without more, was not money transmission requiring licensure. See Division of Banks, Opinion 19-008 (Jan. 17, 2020). A digital wallet service was also found, on its facts, not to require a license. See Division of Banks, Opinion 20-003 (May 22, 2020).

Selected Department of Banking opinion letters on virtual currency can be found on the Department’s website.

Michigan

MCL 487.1003(c) defines “money transmission” as “selling or issuing payment instruments or stored value devices or receiving money or monetary value for transmission.” Michigan’s Department of Insurance and Financial Services FAQs states that holding funds in an “e-wallet” is money transmission requiring a license. 2019 guidance for consumers and industry states that if federal regulators would require an “administrator or exchanger” to get a money transmission license, one is required under Michigan law.

Virtual currency exchanges such as Binance and Coinbase maintain Michigan money transmission licenses.

Minnesota

Money transmission under Minn. Stat. § 53B.03 is defined as, “selling or issuing payment instruments or engaging in the business of receiving money for transmission or transmitting money .” Licenses are required for “businesses that cash checks, transmit money, own and operate ATMs, and provide electronic funds transfers,” according to the Minnesota Commerce Department .

Some virtual currency exchanges such as Binance and Coinbase maintain Minnesota money transmission licenses.

Mississippi

Miss. Code § 75-15-3(f) defines “monetary value” as “a medium of exchange, whether or not redeemable in money,” and Miss. Code § 75-15-3(g) defines “money transmission” to include receiving monetary value for transmission.

Some virtual currency exchanges such as Binance and Coinbase maintain Mississippi money transmission licenses.

Missouri

Missouri’s “Sale of Checks” law defines a “check” as “any electronic means of transmitting or paying money.” Mo. Rev. Stat. § 361.700(2)(1).

Some virtual currency exchanges such as Binance maintain Missouri Sale of Checks licenses.

Montana

Money transmitters do not need a license in Montana, according to the Department of Banking and Financial Regulations.

Nebraska

Nebraska’s money transmission law defines “monetary value” as “a medium of exchange, whether or not redeemable in money,” Neb. Rev. Stat. § 8-2715, and therefore encompasses digital currency.

Effective Oct. 1, 2022, state-chartered “digital asset depository institutions” have the same exemption from money transmission registration as other banks. Neb. Rev. Stat. § 8-2724.

Slot machines and other “mechanical amusement cash devices” may only accept fiat currency or vouchers for same; virtual currency is specifically prohibited. 316 NAC 54-102.05B(5).

Nevada

The definition of “check” in NRS § 671.010(1) includes any “instrument used for the transmission or payment of money,” and a license is required for “selling or issuing checks” or “receiving for transmission or transmitting money or credits.” NRS § 671.040(1).

The Financial Institutions Division released a “statement on regulation of cryptocurrency in Nevada“ stating that whether a business is a money transmitter is determined on a case-by-case basis; however, “any entity that facilitates the transmission of or holds fiat or digital currency by way of brick-and-mortar, kiosk, mobile, internet or any other means, should contact the NFID to request a licensure determination.”

Nevada also has a sandbox, the “Regulatory Experimentation Program for Product Innovation” NRS §§ 657A.100 to 657A.620

New Hampshire

A business that solely deals in “convertible virtual currency” as defined by RSA § 399-G:1(VII) is exempt from money transmitter licensing, although still bound New Hampshire’s general unfair trade practices law and regulated by the state Department of Justice’s Consumer Protection Bureau. RSA § 399-G:3(VI)(a).

However, if a business deals in other forms of monetary value, RSA § 399-G:1(XV) expressly includes virtual currency so the business must be licensed under RSA § 399-G:2; see also New Hampshire’s banking department policy statement.

New Jersey

The definition of “payment instrument” in N.J.S.A. 17:15C-2 is broad enough to include virtual currency in New Jeresy’s money transmission licensing scheme. Virtual currency exchanges Binance and Coinbase both maintain New Jersey money transmitter licenses.

New Mexico

Although virtual currency is not explicitly mentioned in New Mexico’s money services business regulation, see NMSA 1978 § 58-32-102, the New Mexico Regulation and Licensing Department considers dealing in virtual currency to require a license. See Financial Institutions Division, Money Services Businesses ; FAQs.

New York

New York’s Department of Financial Services has a special “BitLicense” for virtual currency businesses promulgated at 23 NYCRR §§ 200.1 to 200.22. Nearly any commercial transfer, sale, purchase, or issuance of virtual currency requires a license. 23 NYCRR 200.2(q).

Businesses that engage in the transmission of fiat currency as well as virtual currency require both a BitLicense and a traditional money transmitter license as per N.Y. Banking Law § 641 . See BitLicense FAQs .

See also the Department of Financial Services’ page on virtual currency.

North Carolina

North Carolina’s definition of money transmission requiring a license expressly includes virtual currency. N.C.G.S. § 53-208.42(13)(b), (15). However, an express agent of the payee is still exempt from licensure even if paid in virtual currency. N.C.G.S. § 53-208.44(8). See “Money Transmitter Frequently Asked Questions.”

Money transmitter licensees who deal in virtual currency may have to obtain an increased surety bond. N.C.G.S. § 53-208.47(d). Investments in virtual currency by licensees may be verified at any time by the Commissioner of Banks. N.C.G.S. § 53-208.48(c).

Ohio

Ohio Rev. Code § 1315.01(G)‘s definition of “money transmission” encompasses nearly every transmission of monetary value. The money transmission licensing application provided by the Ohio Department of Commerce requires a dealer in virtual currency to provide a third-party audit of the licensee’s computer systems.

Oklahoma

The definition of “money transmitter” in 6 O.S. § 1512(7) includes any transmission of funds across an electronic network. Many virtual currency exchanges maintain Oklahoma money transmission licenses.

Oregon

In the Oregon money transmitter laws, ORS 717.200(10)(b) defines “money” as a medium of exchange that “represents value that substitutes for currency.” Oregon licenses digital currency exchanges as money transmitters.

Pennsylvania

Although 7 P.S. § 6101 defines “money” as a “product that is generally recognized as a medium of exchange” and a “transmittal instrument” to include “electronic transfer,” the Pennsylvania Department of Banking and Securities issued guidance holding that only fiat currency is “money” and virtual currency trading platforms are exempt.

Rhode Island

Virtual currency transactions are expressly “currency transmission” under Rhode Island law. G.L.1956 § 19-14-1(4)(ii). Currency transmission requires a license, G.L.1956 § 19-14-2(3); however, there are a number of exceptions for specific situations in G.L.1956 § 19-14.3-1. Rhode Island has a list of mandated disclosures virtual currency businesses must make to their customers. G.L.1956 § 19-14.3-3.5. A Rhode Island licensee must maintain enough virtual currency to satisfy all of its customers’ entitlements. G.L.1956 § 19-14.3-3.6.

See also “Rhode Island Currency Transmission Law: Frequently Asked Questions”

South Carolina

The South Carolina Attorney General’s Money Services Division “views virtual currencies as lacking the characteristics necessary to be a medium of exchange” and therefore virtual currency businesses do not need to be licensed. See “Money Services FAQs“ ; interpretive letter of Dec. 5, 2018 .

Virtual currency ATMs are specifically exempt as per an administrative order. Order no. MSD-19003 (Sept. 6, 2109).

South Dakota

South Dakota considers the term “monetary value” in SDCL 51A-17-1(13) to include virtual currency. See Division of Banking, “Virtual Currency Transmission in South Dakota“ (May 25, 2019).

Tennessee

Tennessee does not consider cryptocurrency itself “money transmission,” but many acts of converting virtual currency into fiat currency fall under the definition of money transmission and must be licensed. Tennessee Department of Financial Institutions, “Regulatory Treatment of Virtual Currencies Under the Tennessee Money Transmitter Act“ (Dec. 16, 2015).

Texas

The Texas Department of Banking finds that exchange or transfer of most virtual currencies, standing alone, is not money transmission requiring a license. However, trade in stablecoins, or use of a third-party exchanger (including virtual currency “ATMs”), must be licensed as money transmission. See Supervisory Memorandum 1037, “Regulatory Treatment of Virtual Currencies Under the Texas Money Services Act,” Apr. 1, 2019.

Utah

“Blockchain tokens” are explicitly excluded from Utah’s money transmitter definition. Utah Code § 7-25-102(9)(b).

Virginia

The Virginia Bureau of Financial Institutions holds that virtual currencies are not included in the definition of money transmission under Va. Code § 6.2-1900 although transactions that also involve the transfer of fiat currency may be. “Notice to Virginia Residents Regarding Virtual Currency“ (Aug. 25, 2021).

Washington

RCW 19.230.010(18) specifically states that virtual currency is included in the definition of money transmission. However, the implementing regulations say that storage of virtual currency without the unilateral power to transmit is not money transmission. WAC 208-690-015(4).

Virtual currency money transmitters must have a third party security audit of their computer systems. RCW 19.230.040(5); WAC 208-690-030(7). There are also virtual currency-specific investment and disclosure requirements; RCW 19.230.200(1), RCW 19.230.370, WAC 208-690-085(4), WAC 208-690-205(3). There is a separate minimum net worth requirement for licensees that also store virtual currency. WAC 208-690-060(2).

See also Washington Department of Financial Institutions, “Industry Guidance for Virtual Currency, Cryptocurrency, and Digital Assets”

West Virginia

- Va. Code § 32A-2-1(6)considers “currency transmission” and “money transmission” synonymous, and both include the transfer of “value that substitutes for money.”

However, a licensee under the West Virginia Fintech Regulatory Sandbox does not need to apply for a separate money transmitter license. W. Va. Code § 31A-8G-4(d), (e).

Wisconsin

The Wisconsin Department of Financial Institutions interprets its authority under Wis. Stat. § 217.03 as not extending to the transmission of virtual currency, although dealers in virtual and fiat currency likely need a license for the latter. See “Sellers of Checks.”

Wyoming

“Buying, selling, issuing, or taking custody of payment instruments in the form of virtual currency or receiving virtual currency for transmission to a location within or outside the United States by any means” is exempt from licensing as money transmission under Wyoming law. Wyo. Stat. § 40-22-104(a)(vi).

Furthermore, The Wyoming Financial Technology Sandbox, Wyo. Stat. §§ 40-29-101 through 40-29-109; 021.0008.1 Wyo. Code R. §§ 1 to 8, explicitly applies to money transmission licensing. Wyo. Stat. § 40-22-104(b).

Reference Shelf

Analysis: Crypto Legislation Might Progress Beyond Talk in 2022

Analysis: Bloomberg Law 2023 – The Future of the Legal Industry

Subscribers Only: Crypto News Channel

Subscribers Only: State Digital Currency Chart Builder

Subscribers Only: Fintech Compliance

Recommended for you

With evolving and emerging technologies come new risks, regulations, and responsibilities. Bloomberg Law’s essential news, expert analysis, and practice tools will help you plan ahead.